In this post, we will discuss key takeaways about Rental Market Behavior in 2023

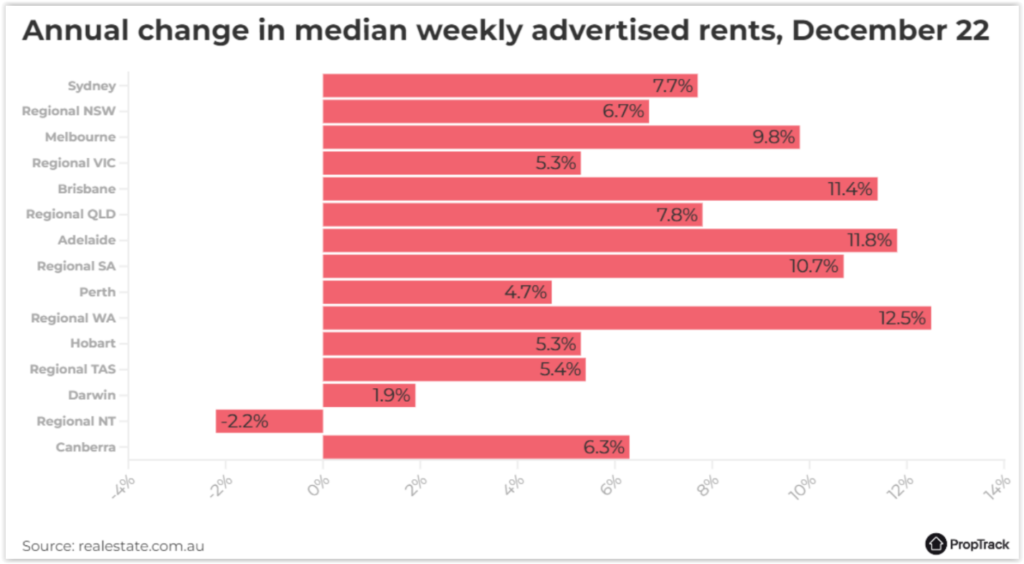

Latest data released by the Australian Bureau of Statistics showed overseas and student arrivals continue to rebound, pointing to ongoing increasing rental demand in the capital cities. At a national level, rental price growth steadied over the December quarter after hitting record quarterly growth in September, although advertised prices still rose by 6.7% over the 2022 calendar year and markets remain tight.

In the capital cities, rents rose 10% in the past year, while regional rents rose 7.1%. Demand for the rental stock remains heightened and supply continues to be limited. Total rental listings remain at their lowest level since mid-2003. Throughout the Covid period, regional rentals surged in popularity, with many opting to take advantage of the increased residential choice brought by hybrid and remote work trends.

This placed enormous strain on rental markets in the regions. In the regions, rental supply remains tight but there has been some reprieve. In December, total regional rental listings were 9.8% higher year-on-year, the largest year-on-year increase since June 2014. However, with the pandemic in the rear-view mirror and borders having reopened, pressure has shifted to the capital cities – particularly the larger ones – and inner-city rental markets have tightened over the past year. In the capitals, total rental listings were 26.3% lower year-on-year in December and are now at the lowest point since February 2003.

You might also like:

> Sydney To Tamworth And Armidale Road Trip

> Why Are We So Afraid To Make High Impact Property Investments?

> How Can Your Decision To Migrate To A City In Australia Affect Your Property Portfolio Down The Track?

Annual change in the median weekly advertised rent

Net migration change

Rental market outlook for the year

The rental market is tight, and rents have been rising because there is excess demand and insignificant supply. With mortgage servicing costs heightened due to higher interest rates, people moving back to capital cities, and overseas migration lifting, it looks unlikely that the high level of demand will reduce, particularly in capital cities.

At the same time, the share of lending to investors is low and investors face higher mortgage interest costs than owner-occupiers. The most effective way to alleviate rental pressures in the short term is to encourage more investment in housing. Addressing the demand and supply dynamic will take some time which means that supply is likely to remain tight and the cost of renting will increase.

You might also like:

> 8 Best Government High Schools In Sydney

> Why Health Is Your Greatest Wealth

> Are You Thinking About Starting A Self-Managed Superannuation Fund (SMSF)?

Disclaimer: Articles in this blog are just the author’s or authors’ personal opinions.

It may or may not be correct. Please do your own due diligence and seek professional advice according to your own personal circumstances. The author or authors cannot be held responsible/liable for any content in this blog.

*all images are for illustration purposes only