Rental yields are a critical metric for property investors, providing insight into the potential returns on investment from rental income. Understanding and calculating rental yields can help investors make informed decisions and maximize their returns.

What is Rental Yield?

Rental yield is the annual rental income generated by a property as a percentage of its market value. It serves as an indicator of how much income an investment property is likely to produce relative to its cost. There are two main types of rental yields: gross rental yield and net rental yield.

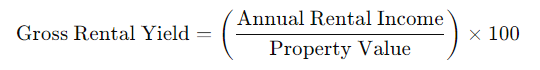

- Gross Rental Yield:

- This is the total annual rental income before any expenses, divided by the property’s market value. It’s a quick way to estimate the income potential of a property.

- Formula:

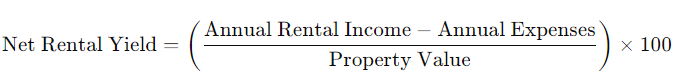

- Net Rental Yield:

- Net rental yield takes into account the property’s operating expenses, such as maintenance, management fees, insurance, and taxes. It provides a more accurate reflection of the actual income you can expect from the property.

- Formula:

Why Rental Yield Matters

Rental yield is an essential factor for investors because it helps determine the profitability of a property. High rental yields generally indicate a better return on investment, making it a key consideration when evaluating potential investment properties.

- Comparison Tool: Rental yield allows investors to compare different properties and assess which ones offer better returns.

- Risk Assessment: Lower rental yields might indicate higher risk or lower income potential, which is crucial for risk-averse investors.

- Cash Flow Analysis: Understanding rental yields helps investors plan for positive cash flow, ensuring that their rental income covers expenses and generates profit.

Factors Affecting Rental Yield

Several factors can influence rental yield, and it’s important to consider these when evaluating a property:

- Location: Properties in high-demand areas with strong rental markets tend to have higher yields.

- Property Type: Different types of properties (apartments, houses, commercial spaces) may have varying yields based on demand and maintenance costs.

- Market Conditions: Economic factors, interest rates, and local market conditions can impact rental yields over time.

Tips for Maximizing Rental Yield

- Research the Market: Thoroughly research the local rental market to understand average rental prices and demand.

- Consider Renovations: Upgrading or renovating a property can increase its rental value and yield.

- Efficient Management: Keeping operating costs low through efficient property management can boost net rental yield.

Understanding and calculating rental yields is vital for making informed property investment decisions. By analyzing rental yields, investors can assess the potential profitability of a property and ensure they are making wise investments.

For more detailed insights and personalized advice on property investment, contact the Property Buyers Australia Group at 0432 555 415 or visit propertybuyersaustraliagroup.com.au.